The novel concepts introduced by FX Physics are applied through entirely redesigned wavefunctions that extract the core

drivers of those specific price motion dynamics pertaining to each actively traded asset class. This universal yet

discriminating 'True Price Motion Dynamics' (TPMD) algorithmic architecture provides all systems with a singular

relevance as a trading solution. The base algorithm led to the birth of F_Core and X_Core which were respectively

applied to the Index Futures and Forex markets for their high liquidity, long trading hours, and ease of leverage. From

there, all other subsystems were derived and developed.

The TPMD mathematical framework may be non-trivial but its trading implementation is very simple, or rather, 'simplex' as I call it. Each system is assigned a set of trading rules that is exceptionally compact and straightforward. What the algorithm does is that it crunches numbers at the end of each price bar on any relevant time frame. It then outputs the trigger level at which the trader should buy or sell on the N-th price bar of the same given time frame. Such clarity and versatility provide the trader with a myriad of possible applications that range from intraday scalping to long-term portfolio investments, with trading costs setting the only limitation. The algorithm also proves low maintenance as its good working order requires minimal input and monitoring. The result is two-fold: an expectancy mapping of the market ahead of time and a real-time signal that is both quantified and actionable.

The TPMD mathematical framework may be non-trivial but its trading implementation is very simple, or rather, 'simplex' as I call it. Each system is assigned a set of trading rules that is exceptionally compact and straightforward. What the algorithm does is that it crunches numbers at the end of each price bar on any relevant time frame. It then outputs the trigger level at which the trader should buy or sell on the N-th price bar of the same given time frame. Such clarity and versatility provide the trader with a myriad of possible applications that range from intraday scalping to long-term portfolio investments, with trading costs setting the only limitation. The algorithm also proves low maintenance as its good working order requires minimal input and monitoring. The result is two-fold: an expectancy mapping of the market ahead of time and a real-time signal that is both quantified and actionable.

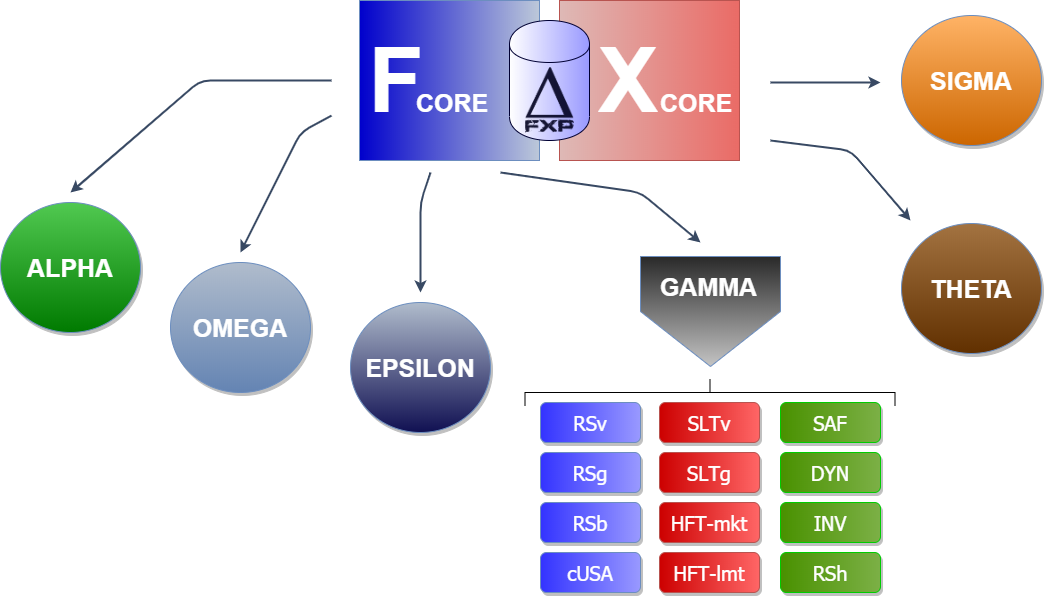

The FX Physics suite of trading systems is powered by 2 core algorithmic engines: F_Core and X_Core that are applied to

Index Futures and Forex trading, respectively; and of an additional 6 secondary engines, namely Omega, Epsilon, Sigma,

Alpha, Gamma and Theta applied to a wider array of investment vehicles ranging from Futures & Forex (including CFDs), to

Options, Equities and ETFs.

The suite is organized as follows.

The suite is organized as follows.

FX Physics' algorithmic engines are extremely versatile. They not only offer an edge in any market, they also provide an

investment solution that caters to every trader, be it in terms of frequency, risk-aversion, or the ability to trade on margin.

The table below summarizes these characteristics engine by engine.

The table below summarizes these characteristics engine by engine.

A brief description of the 6 systematic sub-engines follows.

OMEGA is a direct by-product of the F_Core engine that picks up price inertia. It is suitable for Index Futures as well as ETFs. It may be used as a stand-alone short-term strategy or can play a core role within a delta-one directional portfolio pegged to the SP500 index as its benchmark. With a trading logic going both long & short, it is the perfect instrument to claim that extra residual 'alpha' in bull markets and reduce volatility in bear markets.

EPSILON is a mean reversion sub-engine which is also derived from the F_Core engine, then reapplied to the Index Futures and ETF markets to help benchmarked portfolios beat the SP500 index on both risk and return. It capitalizes on a collective investor bias that causes recurring market 'errors' in the actual stretch of short-term movements. These errors are not frequent and the system typically yields only 8 trades per year. However, it captures those flawlessly with a staggering 83% winning rate. Unlike Omega, it is better suited as a low maintenance add-on strategy to complement a traditional portfolio since it trades less agressively and less frequently.

SIGMA is derived from X_Core. It is a niche sub-engine demonstrating the relevance of the TPMD algorithm on fast, intraday time frames and stands at the very frontier of profitability imposed by transaction costs and slippage. This short-term, volatility expansion sub-engine aims to capture the early stages of price fractals, typically the first 10% to 15% of a larger development. By doing so, it reaps the rewards of both sideways motion and jump diffusion even in case of the abortion of a fractal formation. It is also very useful to complement a longer-term strategy as it will typically relay it and smooth out its equity curve in times of seemingly flat markets.

ALPHA is a complete equity investment solution designed to improve on so-called 'Buy & Hold'. The sub-engine is totally dedicated to long-term ETF investing but adds a one-two twist to your regular passive strategy by both lowering volatility and increasing returns. First, it uses the TPMD algorithm as a market timing tool allowing it to arbitrage a portfolio of ETFs with maximum efficiency. Second, it uses a regime filter to single out bull & bear markets and keep the investor out of extreme market conditions. The system only trades long but may be expanded to futures and commodities in order to maximize decorrelation. It was backtested over 90+ years and has consistently beaten the SP500 index on both risk and return.

GAMMA encompasses a blend of 12 systems using the many capabilities of the TPMD algorithm. It is applied to highly liquid equities and ETFs by spotting fractal breaks and likely short-term reversals/continuations. Thanks to its embedded kill switch techniques, the engine's speculative nature is offset by its tight risk management and directional neutrality over time. Every day, week or month after the close, the algorithm scans the market for opportunities and yields a list of tickers to trade on the following day. For those traders wishing to be more aggressive, Gamma also easily allows scaling with the use of leverage. Lastly, its suite of systems offers a minimal impact on liquidity by focusing on highly liquid universes such as the SP500, SP100 and Nasdaq Composite indices. This low impact on liquidity is further reinforced by TPMD's non-parametric reliance allowing to spread executions across a wide array of market levels without sacrificing efficiency or performance.

THETA is a trading system that leverages the volatility modeling ability of the TPMD algorithm to accurately trade covered options or simply to improve timing on ETF and equity trades. On options, Theta indicates appropriate strike placement and optimal maturity up to 6 months ahead of time. It confronts realized vs implied vs expected volatility to find the flaws in the volatility density priced in by the options market, in particular as relates to the known flaws in the VIX index valuation beyond 30 days out. The results are always optimal annualized returns coupled with drastically reduced risks of assignments.

OMEGA is a direct by-product of the F_Core engine that picks up price inertia. It is suitable for Index Futures as well as ETFs. It may be used as a stand-alone short-term strategy or can play a core role within a delta-one directional portfolio pegged to the SP500 index as its benchmark. With a trading logic going both long & short, it is the perfect instrument to claim that extra residual 'alpha' in bull markets and reduce volatility in bear markets.

EPSILON is a mean reversion sub-engine which is also derived from the F_Core engine, then reapplied to the Index Futures and ETF markets to help benchmarked portfolios beat the SP500 index on both risk and return. It capitalizes on a collective investor bias that causes recurring market 'errors' in the actual stretch of short-term movements. These errors are not frequent and the system typically yields only 8 trades per year. However, it captures those flawlessly with a staggering 83% winning rate. Unlike Omega, it is better suited as a low maintenance add-on strategy to complement a traditional portfolio since it trades less agressively and less frequently.

SIGMA is derived from X_Core. It is a niche sub-engine demonstrating the relevance of the TPMD algorithm on fast, intraday time frames and stands at the very frontier of profitability imposed by transaction costs and slippage. This short-term, volatility expansion sub-engine aims to capture the early stages of price fractals, typically the first 10% to 15% of a larger development. By doing so, it reaps the rewards of both sideways motion and jump diffusion even in case of the abortion of a fractal formation. It is also very useful to complement a longer-term strategy as it will typically relay it and smooth out its equity curve in times of seemingly flat markets.

ALPHA is a complete equity investment solution designed to improve on so-called 'Buy & Hold'. The sub-engine is totally dedicated to long-term ETF investing but adds a one-two twist to your regular passive strategy by both lowering volatility and increasing returns. First, it uses the TPMD algorithm as a market timing tool allowing it to arbitrage a portfolio of ETFs with maximum efficiency. Second, it uses a regime filter to single out bull & bear markets and keep the investor out of extreme market conditions. The system only trades long but may be expanded to futures and commodities in order to maximize decorrelation. It was backtested over 90+ years and has consistently beaten the SP500 index on both risk and return.

GAMMA encompasses a blend of 12 systems using the many capabilities of the TPMD algorithm. It is applied to highly liquid equities and ETFs by spotting fractal breaks and likely short-term reversals/continuations. Thanks to its embedded kill switch techniques, the engine's speculative nature is offset by its tight risk management and directional neutrality over time. Every day, week or month after the close, the algorithm scans the market for opportunities and yields a list of tickers to trade on the following day. For those traders wishing to be more aggressive, Gamma also easily allows scaling with the use of leverage. Lastly, its suite of systems offers a minimal impact on liquidity by focusing on highly liquid universes such as the SP500, SP100 and Nasdaq Composite indices. This low impact on liquidity is further reinforced by TPMD's non-parametric reliance allowing to spread executions across a wide array of market levels without sacrificing efficiency or performance.

THETA is a trading system that leverages the volatility modeling ability of the TPMD algorithm to accurately trade covered options or simply to improve timing on ETF and equity trades. On options, Theta indicates appropriate strike placement and optimal maturity up to 6 months ahead of time. It confronts realized vs implied vs expected volatility to find the flaws in the volatility density priced in by the options market, in particular as relates to the known flaws in the VIX index valuation beyond 30 days out. The results are always optimal annualized returns coupled with drastically reduced risks of assignments.

First and foremost, because the TPMD algorithm relies on a single

hard-wired physics formula, it is agnostic to parametric

sensitivity and therefore works with zero optimization which is

the root of all evil in algorithmic trading. Absolutely no

curve-fitting was used to elaborate or fine-tune the F_Core and

X_Core source systems. For those subsystems which use

spectral optimization, algorithmic relevance and the very low

number of degrees of freedom ensures that profitability remains

maximal across a massive and stable array of inputs. In fact, it is

hard to find sets of parameters for which the systems do not

work! This feature alone sets TPMD way apart from the

competition. While most systems undergo heavy optimization to

barely work within a specific historical sample and a particular

set of parameters, others will claim to 'only' need periodic

re-optimization to hide the fundamental weakness of their

design. The fact is that ANY optimization used as a base system

architecture leads to failure. These locally optimized systems go

nothing further than throwing darts onto a wall and redrawing

the target around them. Anyone can hit the bull's eye that way.

For this very reason, these shaky systems will work wonders on

in-sample data but will degenerate miserably as soon as they are

thrown into the real world. Instead, by using the exact same

structure and set of trading rules even as volatility evolves,

TPMD delivers total performance consistency over and over,

whether backtested on historical data or trading on

live/out-of-sample data. The TPMD algorithm makes worrying

about parameters a thing of the past.

NON PARAMETER-CENTRIC

This feature is a direct benefit of TPMD not being parameter

centric. Because TPMD is not optimized, its universal trading

edge is smoothly transferable to any market with the same

relevance. Therefore, the core systems are naturally adapted to

other markets than Index Futures & Forex with no need for

further adjustment or specific tuning. Omega, Epsilon, Sigma,

Alpha and Theta are virtually oblivious to parametric settings and

will work across an infinity of inputs. Beware of systems

designed specifically for a predefined market or specific

parameters. In itself, this very clue screams 'optimization'. It

shows right away that the system is flawed, curve-fit, and will

not withstand the test of time.

MULTI-MARKETS

Because the TPMD algorithm does not rely on optimization, it can

trade profitably in whatever direction that the market takes it.

None of its trading systems are biased in any way to trade long

just because the data over which they were backtested was

bullish, or vice-versa. TPMD is indifferent to prior data and will

simply react in the way the market requires it to, without being

pre-conditioned. Only Theta was intentionally restrained to short

positions due to the very nature of its objective to sell volatility

by shorting options as a strategy typically used in tandem with a

broader, long-term, more traditional equity investment solution.

LONG/SHORT AGNOSTIC

Unsurprisingly, because of its independent behavior, the TPMD

algorithm generates profit that is largely or totally decorrelated

from the intrinsic performance of the underlying instruments that

it trades. As a result, any TPMD-based system may be used both

as a stand-alone investment solution, or as a way to diversify a

broader portfolio of more traditional instruments or systems in

order to smoothen or partially hedge overall performance.

SCALABLE DECORRELATION

Even the best trading system would be worthless if its

profitability relied on a few big moves followed by long stretches

of flat-lined equity progression, or by an otherwise steady

appreciation broken on many spots by steep drawdowns. What

we want instead is a smoothly rising equity curve, which

spreads out positive performance as evenly as possible through

time. Also, practice shows that a trader's discipline tends to

erode as sharp losses occur. A well-designed system will

therefore foster performance both through its own ability to

generate profit as well as by keeping intact the trader's

confidence in applying the rules to the letter. TPMD offers no

crystal ball and does generate drawdowns as any other

solution. However, these are kept to the bare minimum

relatively to returns both in terms of magnitude and duration.

There again, when it comes to consistency, TPMD delivers.

STABLE EQUITY CURVE

An algorithm may only be successful if its translation from the

drawing board to the trading blotter is free from clutter and its

execution is spot on. The FX Physics project aimed to keep it

simple from the start. The algorithm's core logic is made of a

few streamlined trading axioms that are extremely easy to

apply. The TPMD algorithm focuses on its reactive power by

mapping the market with a succession of trigger levels

maximizing positive expectancy. These trigger levels simply may

or may not be crossed. As such, TPMD-derived systems may be

implemented as 'set-and-forget' solutions where orders are

entered at the end of each price bar. The trader may then walk

away from its screens until the relevant price bar ends, thereby

keeping its involvement to a minimum.

LOW MAINTENANCE

NON-DISCRETIONARY

The TPMD algorithm obviously follows a 100% mechanical

process. There is zero guesswork involved in the execution, no

market analysis, no fundamentals etc... Absolutely no subjective

interpretation of the market is required for it to work. All that

the trader needs to do is obtain the trigger levels for the next

bar, enter the trade, and walk away. Only discipline is needed.

No pre-written money management is deemed as 'optimal' for

any system. Still, from the extensive backtesting of up to 100

years was derived a fairly accurate level of the maximum

expectable drawdown that a trader may sustain for any given

system. Not surprisingly, because of the algorithm's relevance,

the performance disparity within each market across each

system is relatively tight. Depending on the instrument that an

investor decides to trade, each position size may be scaled with

ease while knowing in advance what kind of drawdown is to be

expected in the worst case scenario. That flexibility needs to

work in tandem with defining for each investor what his own

risk-aversion and drawdown tolerance are. As a general

guideline, however, FX Physics' trading solutions target a

sustainable MAR Ratio of between 0.75 and 1.50, which is very

high by any standard.

FLEXIBLE MONEY MANAGEMENT

AUDITED LIVE TRADING

Backtesting is vital when it comes to assessing a system's

behavior and profitability. But nothing beats the test of live

trading that involves all the pitfalls of reality such as slippage,

actual limit fills, execution errors and trading discipline. Trading

FX Physics' systems live, whether on a simulated or a

real-money basis, should not come as an astonishing

commitment. In fact, this is the least that you could expect

from a trusted trading solution engineer. I believe that fairness

requires that the FX Physics project does not remain at the

stage of clever modeling, thorough backtesting, and

profitability claims. Instead, we go one step further in asserting

the algorithm's integrity by trading its systems live and building

long-term track-records. This genuine performance history is

audited by a third-party to relieve any doubt as it is made

accessible and transparent to anyone; with institutional

credentials only required to view real-money records. The goal

here is evidently to provide institutions and traders with an

authentic frame of reference to assess all performance claims

and realize how closely real trades replicate backtested

results.

NOT FOR SALE

Doesn't it sound profoundly antinomic that anyone with a

performing algorithm in a finite liquidity environment would be

willing to sell their edge? What kind of price tag would you put

on a legal license to print money? How would you calculate the

NPV of an infinite income stream? None of these questions ask

for a sensible answer. The industry is simple. Algorithmic trading

accounts for a massive proportion of the volume traded each

day and the major players spend huge sums of money each year

to develop their own algorithms. Right there, intellectual

property is paramount. The reason why the FX Physics project is

safely kept family-owned is no different. And the same principle

should hold true for any profitable system operating within tight

liquidity. By definition, the corollary is self-evident. Selling a

winning algorithm makes no economic sense if sharing it implies

less profit for its developer. And any system logic left up for sale

therefore 'must' either be a watered down version of the original

or outrightly flawed.

Those are the top 10 features that set the TPMD algorithm in another league when it comes to robustness, accuracy and simplicity.

Traders, investors, portfolio managers, brokers, advisors... risk-taking is our business. While securing capital protection at all

times, our duty as professionals is to grow equity. Reaching that goal requires making sense of randomness amid erratic

volatility, a confusing information flow and ever increasing sophistication of financial products. Finding a consistently profitable

edge in any market is crucial. FX Physics can help provide both buy side and sell side value. Here is how.

ABSOLUTE PERFORMANCE

CUT COSTS, BOOST FEES

BOOST REVENUE

VERSATILITY

CLIENT RETENTION

STRONG FIDUCIARY ETHICS

CONTROLLED RISK

LOW STRESS

GENERATE IDEAS

Uncorrelated trading logic to

profit in bull, bear, and

sideways markets. Retain

your credibilty as a pro.

Expand your expertise &

opportunities. Every market is

covered through 8 algorithmic

engines and a comprehensive

suite of 29 systems.

Skip the next bear market &

preserve your capital. All

systems come with tight risk

management & kill switches.

Cut your MIFID research

budget to a trickle as your

robust performance warrants

higher fees and attracts

larger AUM.

A value proposition with no

substitute limits switching.

Do you know many PMs able

to perform in ALL markets?

Rely on an absolute edge

tested over 300+ combined

years across 7 asset classes

and financial intruments.

Dial up portfolio turnover

without sacrificing your

client's performance.

Reliably determine suitability &

appropriateness thanks to a

predictable investment solution

that is finely tuned in with your

client's risk aversion &

expectations.

Keep up the deal flow. Call

your clients with numerous

quantified & actionable

trading ideas every single

day, in any market.

As featured in:

Our IT resources:

users, for an improved viewing experience, please flip to landscape mode.

v1.58.137 and beyond.

The following website is dedicated to algorithmic trading with applications expanding from the Forex market to any tradable asset class.

The FX Physics© algorithm, its F_Core© and X_Core© core systems, its Omega©, Epsilon©, Sigma©, Alpha©, Gamma© and Theta© subsystems, their future updates, as well as derived products, services and publications are the sole and exclusive intellectual property of its owner. The entire www.fxphysics.com website content is supported by international copyright laws. The illicit reproduction of all or any part of this website prior to any explicit authorization from its author will be strictly prosecuted. By entering this website, you willfully accept that anything that you may learn from it is for your personal use only. You unconditionally give up any right to share, resell or broadcast any of its trading related knowledge, analysis, techniques or signals.

All information posted on this website reflects the author's opinion and the opinion of its accredited participants, and may not be the truth. Please use your own good judgment and seek advice from a qualified consultant before believing and accepting any information posted on this website. The author of this website/algorithm/trading systems shall not, in any way whatsoever, be held responsible for the reliability or accuracy of the information available on this website. The content provided is put forward in good faith and believed to be accurate. However, there are no explicit or implicit warranties of accuracy or timeliness being made. FX Physics© and his author invite everyone to exercise their own discretion before committing their own funds to any trading strategy. As a result, FX Physics ©, his author and his contributors shall not, in any way whatsoever, be held liable for any adverse financial consequences caused directly or indirectly by the implementation of the presented systems, strategies, methods, processes, services, advice, tips, comments or any information contained therein.

Risk Warning! This website is neither a solicitation nor an offer to trade in the financial derivatives markets. Leveraged trading is a highly technical way of investing which carries a high level of risk. Therefore it may not be suitable for all investors as the use of margin creates large potential for gains but at least equally large potential for losses. Before participating in this type of trading, you should carefully assess your personal financial knowledge, investment objectives and risk tolerance. A substantial possibility does exist that you could sustain a loss of some, all, or even more than your initial investment. As a result, always trade with money that you can afford to lose. In particular, you should be aware of all the risks associated with Forex and Futures trading and seek advice from an independent financial advisor if you have any doubts.

CFTC Rule 4.41 Hypothetical or simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Since these trades have not been executed, the results cannot completely account for the impact of certain varying trading factors such as transaction costs, slippage, execution delays or adhering to a particular trading discipline in spite of trading losses. These examples are some of the material points that may adversely affect actual trading performance and therefore cause the final performance to deviate materially from that stated in this website. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown in the future.

The FX Physics© algorithm, its F_Core© and X_Core© core systems, its Omega©, Epsilon©, Sigma©, Alpha©, Gamma© and Theta© subsystems, their future updates, as well as derived products, services and publications are the sole and exclusive intellectual property of its owner. The entire www.fxphysics.com website content is supported by international copyright laws. The illicit reproduction of all or any part of this website prior to any explicit authorization from its author will be strictly prosecuted. By entering this website, you willfully accept that anything that you may learn from it is for your personal use only. You unconditionally give up any right to share, resell or broadcast any of its trading related knowledge, analysis, techniques or signals.

All information posted on this website reflects the author's opinion and the opinion of its accredited participants, and may not be the truth. Please use your own good judgment and seek advice from a qualified consultant before believing and accepting any information posted on this website. The author of this website/algorithm/trading systems shall not, in any way whatsoever, be held responsible for the reliability or accuracy of the information available on this website. The content provided is put forward in good faith and believed to be accurate. However, there are no explicit or implicit warranties of accuracy or timeliness being made. FX Physics© and his author invite everyone to exercise their own discretion before committing their own funds to any trading strategy. As a result, FX Physics ©, his author and his contributors shall not, in any way whatsoever, be held liable for any adverse financial consequences caused directly or indirectly by the implementation of the presented systems, strategies, methods, processes, services, advice, tips, comments or any information contained therein.

Risk Warning! This website is neither a solicitation nor an offer to trade in the financial derivatives markets. Leveraged trading is a highly technical way of investing which carries a high level of risk. Therefore it may not be suitable for all investors as the use of margin creates large potential for gains but at least equally large potential for losses. Before participating in this type of trading, you should carefully assess your personal financial knowledge, investment objectives and risk tolerance. A substantial possibility does exist that you could sustain a loss of some, all, or even more than your initial investment. As a result, always trade with money that you can afford to lose. In particular, you should be aware of all the risks associated with Forex and Futures trading and seek advice from an independent financial advisor if you have any doubts.

CFTC Rule 4.41 Hypothetical or simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Since these trades have not been executed, the results cannot completely account for the impact of certain varying trading factors such as transaction costs, slippage, execution delays or adhering to a particular trading discipline in spite of trading losses. These examples are some of the material points that may adversely affect actual trading performance and therefore cause the final performance to deviate materially from that stated in this website. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown in the future.

Copyright 2024 © FX Physics. All Rights Reserved.

GOVERNMENT-REQUIRED DISCLAIMER

Site Map

- Home

- About

- Track Record

- The Algo

- Trade

- Learn

- Shop

- Donate

- Privacy Policy

- Terms & Conditions

- About

- Track Record

- The Algo

- Trade

- Learn

- Shop

- Donate

- Privacy Policy

- Terms & Conditions

Optimized for

Web Design Tools

Partners

- FundSeeder

- Collective2

- Myfxbook

- Collective2

- Myfxbook

Trading Software

- MetaTrader 4

- TWS

- FX Synergy

- Amibroker

- TWS

- FX Synergy

- Amibroker

Brokers & IT

- Interactive Brokers

- ICMarkets

- Axitrader

- FXVM

- ICMarkets

- Axitrader

- FXVM

Get in Touch